Connecting Marketing Data to Member Growth for CBC FCU

For the past 5 years, 454 Creative has worked with CBC Federal Credit Union to transform their scattered marketing efforts into focused strategies that drive new member growth and retention.

Who is CBC

CBC Federal Credit Union is based in Ventura County, with a mission to empower members along their financial journey through personalized and innovative service. CBC prides themselves on having a variety of personal services such as checking and saving accounts, retirement options, loans, and much more to fit the needs of their members. Today, CBC Federal Credit Union has four branch locations throughout Ventura County.

Where We Started

Five years ago, 454 Creative began our engagement with CBC by completing a Lean Marketing Framework, a foundational element to our agile and lean methodology. While their leadership came to us with specific needs and changes they wanted to implement, it was important to take time to understand their competitive landscape, refine their brand messaging, define their customer journey and develop a 3-month tactical plan for execution. Our team also audited their digital ads and website and found the quality of the creative elements and customer experience for their current and future members was lackluster. With their current website, members were having to navigate confusing pathways leading to text-heavy pages with usability issues arising and no lead capture on their site—which inherently led to low engagement from both organic and paid traffic. Additionally, without a process to connect marketing data to member data, there was no way to track leads or attribute their marketing activities to member growth.

Improving the Digital Experience

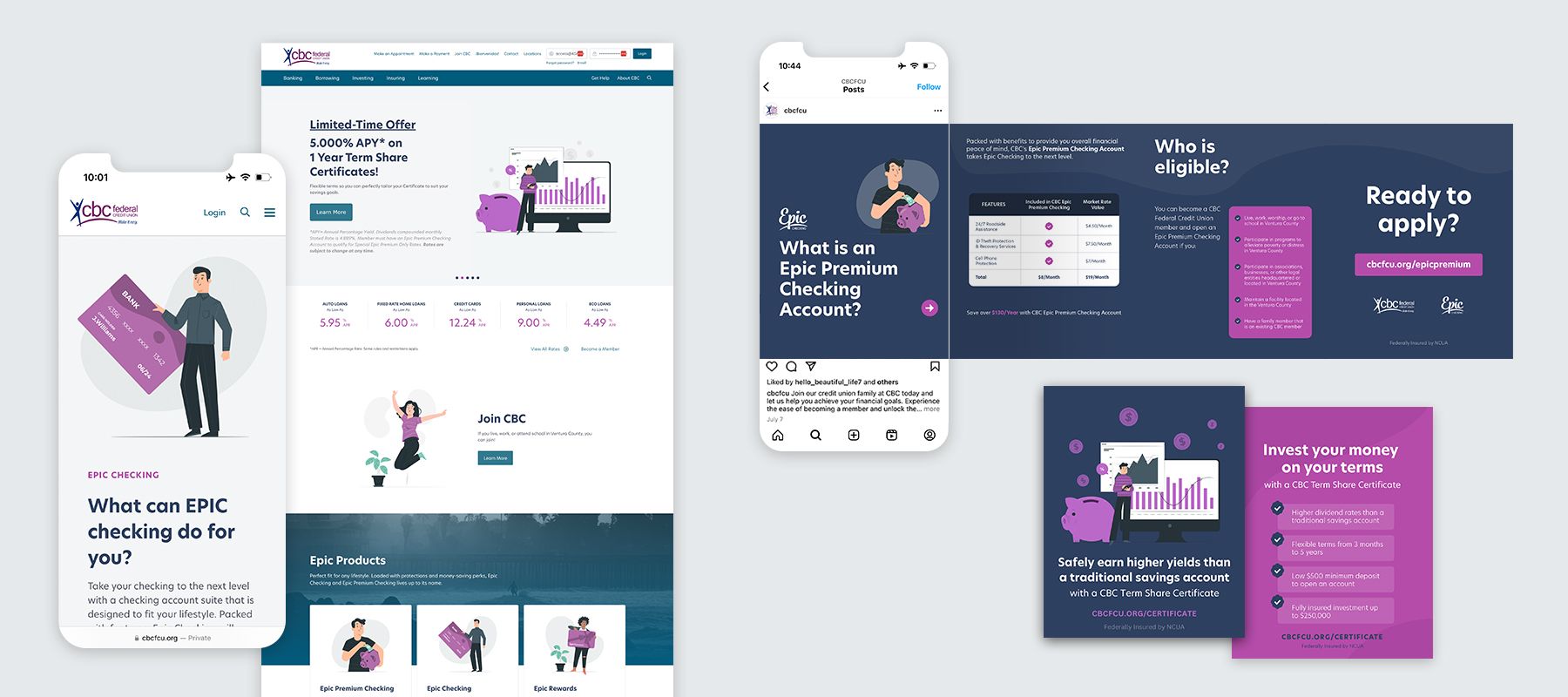

We love creating websites for clients that are visually engaging and results-driven. Our process began with developing a Website Roadmap, which included documenting project priorities, defining CBC’s desired future state, identifying the appropriate technology stack, creating the final website architecture, and building out key wireframes. This process ensured that the Credit Union’s key stakeholders were aligned and that we had a clear path for the design, content, development, and deployment of the new site.

After months of collaboration and hard work, in June 2021 we launched the new CBC Federal Credit Union website. One of our many goals with this new site was designing the content to be mobile-friendly, customer-centric, ADA accessible, and optimized for lead captures to increase the digital experience for members, and to improve conversion rates.

From the launch of the site in June 2021 to March 2023, members have been exploring more of the site content, visiting an average of 6.04 pages on the site, up from 1.64 pages per session. Resources, content, and products have not only become easier to navigate but also more engaging and visually stimulating. Additionally, with the site being optimized for search, there has been a noticeable growth in organic search traffic, from 24% to 34% of overall traffic.

Turbo Charging Lead Generation

With a new-and-improved website, we were able to leverage Google Ads for CBC, promoting their Jumbo Real Estate Loans. We focused on making CBC one of the forefront options for people looking to refinance their homes. Using the learnings from their Lean Marketing Framework, we chose to run a Google Keywords campaign, selecting search terms and optimizing their ads to focus the audience and expand the reach to potential clientele looking to fund their home loans.

As a result, over 89,900 impressions were made in online advertisement appearances. This led to 5,190 prospects checking out the product, and 57 conversions completing loan applications. The campaign culminated in a jump from 6 loans funded in 2019, to 52 loans funded in 2020 directly attributed to the campaign. CBC Federal Credit Union is expecting to yield a whopping 680% return on advertising spend!

“One of the specific ways we have been impacted by the marketing work of 454 is tracking leads by far! Before working with 454, we had no mechanism in place for tracking leads at all. Their team and methods got us into the business of measuring results.” - Lucas Danner, Former CBC AVP of Marketing

Introducing Marketing Automation

Lastly, in February 2022, we worked with CBC to implement HubSpot, a robust CRM platform with software, integrations, and resources needed to connect marketing, sales, content management, and customer service.

Before working with Hubspot, CBC spent many hours working on manual documentation through other methods. Now they can house all of their customer relationship management data in one platform to give multiple departments access to the same information — rather than different departments housing the information. Before working with HubSpot, CBC had several siloed systems that couldn’t talk to each other. Most member data was isolated in their core system, Symitar, and any sort of marketing communication relied on broad outreach rather than the members’ specific needs or interests. Potential members who had responded to ads were only captured in a spreadsheet. By integrating HubSpot with the data in Symitar, the marketing team finally had the ability to engage their members with relevant content. In addition, with all of the prospect data in one place, Marketing and Sales were able to collaborate seamlessly and not only prevent leads from slipping through the cracks but connect the dots between the marketing tactics and the new business they won.

“454 Creative onboarding our team with HubSpot marketing automation has been the biggest help in alleviating our marketing efforts for sure! With the work of 454 Creative, we are much more up to speed on current technology that we couldn’t have implemented without them. We need that expert outside knowledge to spark movement within our credit union teams.” - Lucas Danner, Former CBC AVP of Marketing

Looking to the Future

Now with the improvements to the digital experience, improved lead generation, and appropriate data management CBC now has the marketing and sales infrastructure to support their desired growth into new markets. A total transformation of their marketing efforts means leads are captured through strategic ad campaigns and a user-friendly website are nurtured via vital data connections, ultimately leading to member growth and the fulfillment of organizational objectives.

“Since working with 454 Creative, we have had growth in a time when most Credit Unions are losing members. We have seen a growth of members here at CBC FCU in a climate where the industry is seeing a dying-off of smaller credit unions and member loss.” - Lucas Danner, Former CBC AVP of Marketing

If you are interested in how we can make an impact on growth in your credit union or business, reach out to us via our website today and we would love to connect with you!